Once you reach PMF, you probably have a pretty good idea of what your ideal target market is. Unfortunately, enterprise startups can reach PMF with 20 paying customers, build a repeatable playbook and still fail to unlock growth. The problem is that the initial set of customers only provide an idea, a hypothesis of a potential target market. In order to unlock growth, that hypothesis needs to be validated through go-to-market experiments. The playbook also need to be lined up on a problem that is both a sizeable opportunity and has hair-on-fire urgency for customers.

What determines an ideal target market?

There are three main characteristics of an ideal target market:

- You identified a real addressable Pain(s) with sufficient urgency, tied to business drivers and common enough that you will find other customers with the same pain(s).

- Your Solution provides tangible results that positively impacts their business in a clear, believable, measurable way.

- You are able to build a Target list of prospects or marketing/channel partner options to get access to them.

- Bonus: You know how you uniquely address these pains – your competitive differentiator.

Urgency is important because it answers the critical “why buy now” question for customers. Without it you will have plenty of conversations and opportunities in the pipeline that will never close. Sales cycles will stretch out and growth will be a painful slog.

Ideally the pain you are solving is also tied to a larger strategic value proposition that is part of a large emerging wave (e.g. Artificial Intelligence, Blockchain, Digital Transformation, Mobile etc.). Surfing an emerging wave will help generate awareness and urgency with potential customers, partners, investors and new hires. It may also delay the need to hone in on your competitive differentiator since early enough there is still a lot of green space. Ultimately; however, a competitive differentiator will be necessary to help customers find you, avoid commoditization and win deals against the competition.

Pick a single target market and use case

Finding GTM fit requires making the choice to pick a single target market and use case with the most urgency for customers. This is an especially hard proposition for founders who have a big exciting vision and audacious goals. This is also hard on GTM teams that have to sacrifice the pursuit of other legitimate opportunities with lower urgency but real revenue potential. But this sacrifice is necessary. Finding GTM fit is an experiment, and as with every experiment, variables need to be isolated.

Jason Lemkin and Aaron Ross highlight this in their book From Impossible to Inevitable – a book I highly recommend reading for anyone interested in scaling enterprise SaaS:

Hypergrowth doesn’t come from selling many things to many markets, covering all your bases (really, dividing your energies). Hypergrowth comes from focusing on where you have the best chances of winning customers, making them successful, building a reputation of tangible results, and then growing from there.

So how do you go about finding your sweet spot?

Finding your best potential target market is an 5 steps process. Some of the steps below are inspired or adapted from Lemkin/Ross:

Step 1: Make a list of your best ideas for potential target markets.

Go back to the customers you closed towards the end of your search for PMF and pick out your top 5-10 customers, categories or use cases. The ideal customers not only paid you a lot of money to solve a similar pain but your solution provided them with impressive tangible results in a similar way. I speak to startups that boast an impressive list of customers but they are getting different kinds of value from using the product when you dig deeper – this is a red flag. Your largest deal is not necessarily your ideal target either. More on this in step 3.

Keep listing other potential target markets where you believe you will get the most momentum and where you can find and win deals right away.

Step 2: Retrace your steps and map out the path to a Close

Every GTM strategy can be seen as a black box with sales and marketing activities as inputs, and closed deals as outputs. The goal here is to start decoding the black box by retracing your steps and identifying patterns.

- How did you find these customers? What messaging resonated with them?

- Who were the stakeholders involved?

- What was the pain or problem they wanted to solve?

- Why did they decide to solve it? What triggered them look for solutions?

- Were there specific results they wanted to see?

- What was the solution provided? What did they find compelling about it?

- What made them decide to buy? Who was the decision maker?

- What was the deal size? How long did it take to close the deal?

- To deploy them? For them to get results? How easy was it?

- On a scale of 1 to 10, how much do you want more customers like these?

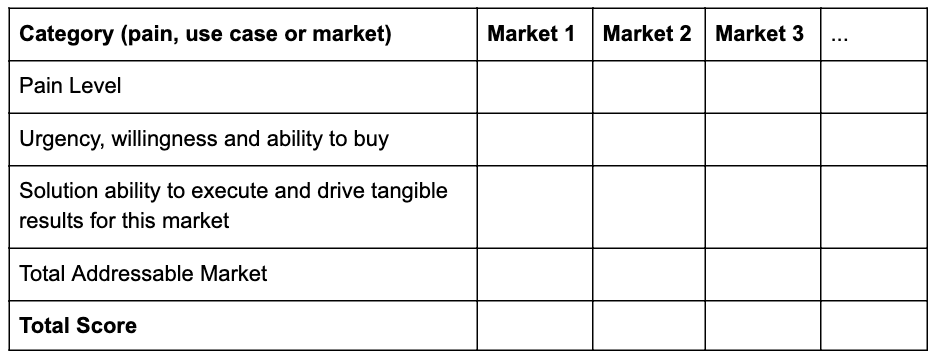

Step 3: Score them

Score the options on your list according to the 3 categories listed above: Pain, Solution and Target. Bonus points if there is also a clear competitive differentiator in an existing/established market. Do a first pass scoring the following general categories between 0-5:

Quick note on the Total Addressable Market: don’t score based on some generic market size but also your ability to put together a list of real targets and prospects to go after.

Step 4: Choose

Narrow down the list above to your top potential targets and look at the details:

- Details on Pain point(s)

- Channel/Medium: How did you get in touch with them? Referral, inbound, cold outbound? Was there a specific compelling event/trigger that made it the right moment?

- Key People: Who was involved in the conversations? roles/titles of people experiencing the pain, power people, champion, economic buyer.

- Business + Personal impact of pain: How does the pain affect their day-to-day, their performance?

- Solution: How did we help them? Was the solution unique/differentiated? Why you?

- Results: What were tangible results they got as a result of using our solution?

- ARR/Tangible expansion opportunities

- Sales cycle length/ease

- Deployment length/ease

Given the details above, would you score your top potential targets differently? Pick one as your first bet. If you are still struggling to narrow down your choice, Lemkin/Ross have a great workbook and Matrix you can use also. But again, you really should buy their book to get the full context!

Step 5: Validate with customers

Before going all out on go-to-market experiments, get started by finding 10-20 more customers to interview. Validate your assumptions about their pain level, ability and willingness to buy, potential results etc. At this time you are not really selling them anything yet so reach out to prospects that will be brutally honest with you. Ask them what it would take for them to buy. Talk to partners. When I lead Go-To-Market for Financial Services at Hootsuite we quickly learned through customer conversations that there were important compliance components missing and that our reps needed to be educated on regulations. We made some tweaks to the Enterprise product, partnered with leading compliance technology providers, hired senior reps and subject matter experts and were able to turn a $0 vertical into a leading business unit doing 10s of millions of dollars. But we had to pause at first and slow down.

If you have made it this far and still have one good bet on the table, congratulations. This is just the beginning of your Go-To-Market experiment and decoding the black box. The first major part of the experiment will be building predictable pipeline generation. But before we get there, there are a couple final housekeeping steps to get us set up properly. Will will address them in our next post.

Thank you for reading!