Before getting started with the steps outlined in the Hypergrowth Sales Playbook, it is important to answer one key preliminary question: when is an enterprise startup ready to think about scaling? In order to tackle that question in this post, we will introduce a big picture framework – the sales learning curve – then align on a starting point by answering a second question: what does Product/Market fit mean for an enterprise startup? This is where Minimum Viable Metrics will come into play.

The Sales Learning Curve

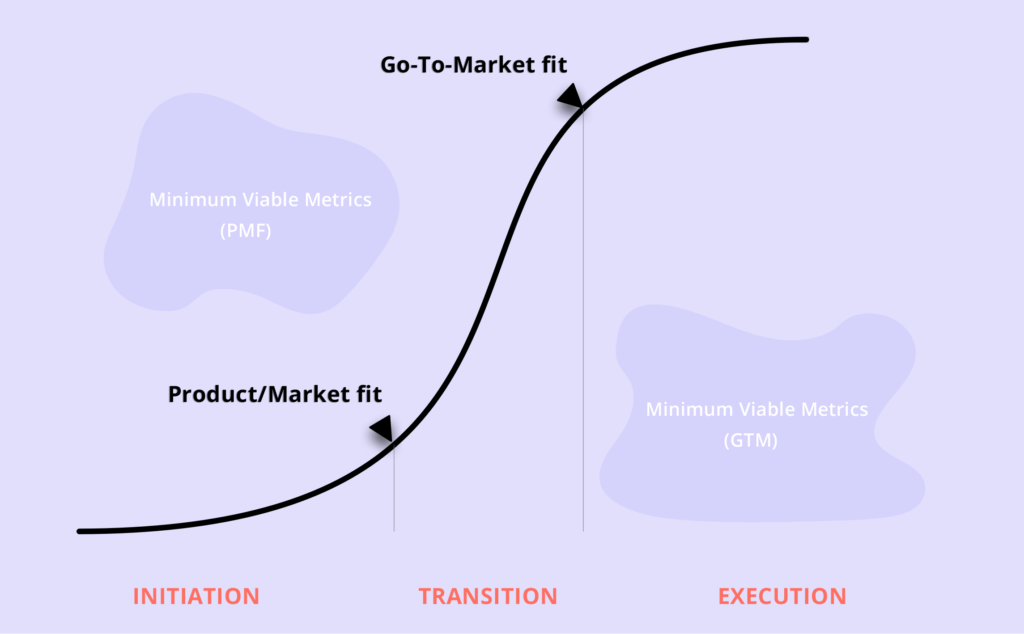

Building out a sales organization and go-to-market model is a reproducible process but it is important to understand that it takes time for a company to learn how to sell its product efficiently. Mark Leslie, former CEO of Veritas Software and Stanford University Lecturer, introduced a helpful framework called the Sales Learning Curve over a decade ago. It describes a model for establishing a go-to-market for a new product and ramping up a sales team in three phases: Initiation, Transition and Execution.

The Initiation phase covers the period from product launch to Product/Market fit . The emphasis for Sales during this phase is to learn as much as possible about how customers intend to use the product and collaborate with the rest of the organization on fine-tuning the product and go-to-market. This involves finding and prioritizing customer pain points, then aligning the product to address those pain points precisely. For SaaS startups with a new product, this roughly corresponds to the Seed stage where selling is mostly founder led, sometimes with the help of a couple of reps.

Once there is a clearer understanding of customer pains, how the product solves them and what price points are acceptable, the Transition phase begins. At this point there is a critical mass of customers, sales are picking up and the initial reps are starting to pay for themselves. The goal is now to get to a scalable, repeatable and cash-efficient business model and growth machine (Go-To-Market fit). Generally in SaaS, this is when a Series A happens along with VP Sales and/or Customer Success hires and their initial teams.

Once Go-To-Market fit has been reached, it’s time to throw gas on the fire. In the Execution stage, SaaS startups go from cash conservation to spending mode which requires capital. Founders will generally raise Series B/Cs + to scale up their Go-To-Market and Product organizations. The sales team is optimized for growth with additional specialty teams to support revenue efforts: lead development representatives, sales trainers, solution consultants, sales operations, account managers, professional services etc. With the formula for success developed and the support structure in place, sales reps now can be hired as rapidly as operational and financial constraints allow.

The phases of the Sales Learning Curve are depicted below.

Minimum Viable Metrics for PMF

Product-Market fit is a well-documented concept with a number of great articles from entrepreneurs and VCs describing what it means and how to find it. That being said, since our primary focus is B2B enterprise startups, it is important to highlight how the concept differs from consumer startups and align on what good looks like.

While consumer startups tend to prioritize adoption and usage metrics to measure Product/Market fit, enterprise startups need to put a strong emphasis on paying reference customers that are getting real value from using the product. This even applies to enterprise startups with a Freemium model since the ability to convert usage into paying reference customers is critical for success. Ultimately, the biggest validation of Product/Market fit for enterprise startups is when initial customers renew or expand. This may be harder to predict from the outset – especially when contracts are prepaid annually – but startups need to keep a close eye on leading indicators of customer success.

So how can we define and measure Product/Market fit for enterprise startups? Christoph Janz from Point Nine Capital perhaps has the best definition I have seen out there:

Product/Market fit means having a product that solves an important problem – without custom work and better than existing solutions – for a significant number of independent customers in a large market.

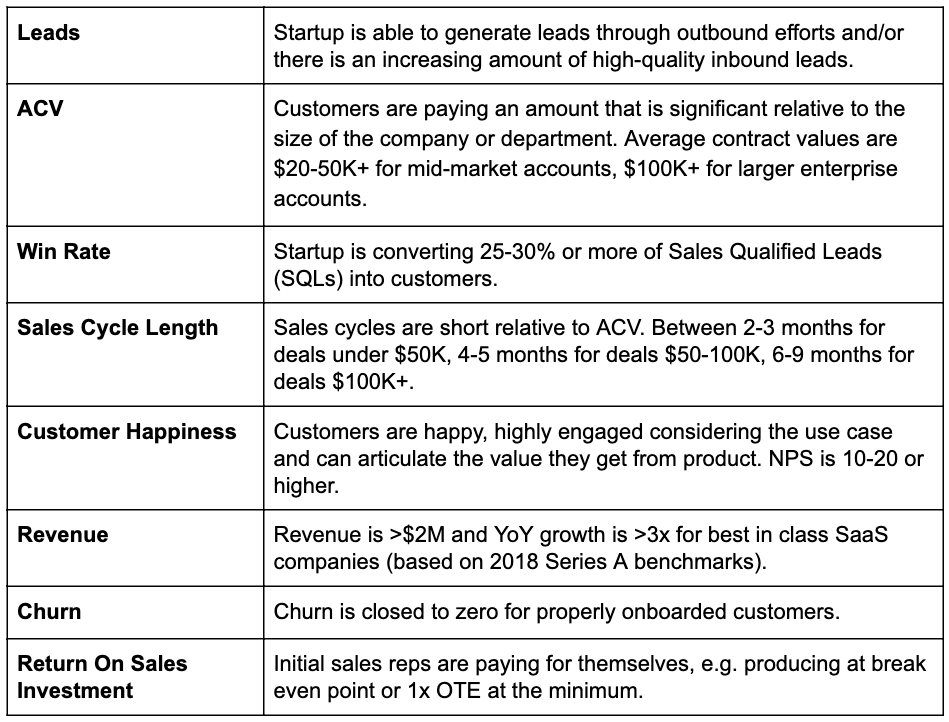

He goes on to provide an overview of some of the factors Point Nine Capital looks at when considering a Seed investment. I have included and adapted some of these factors below in what I call the Minimum Viable Metrics for PMF – a set of metrics and criteria to measure the degree of Product/Market fit of an enterprise SaaS startup.

You can think of the metrics and criteria above as exit milestones for the Initiation phase and the starting point of the methodology we highlighted in the Hypergrowth Sales Playbook. This is not a binary test as realistically any given startup will score better in some areas than others. Looked at together; however, the Minimum Viable Metrics can provide a good picture on the degree to which an enterprise-focused startup has reached Product/Market fit and whether they are ready to think about scaling.

Thank you for reading. In the next post we will look at Minimum Viable Metrics in the context of Go-To-Market fit.