At this point you have identified your best potential target market and validated that it will be the focus on your search for Go-to-Market fit. The process of finding a model can be seen as a black box with sales and marketing activities as inputs, and closed deals as outputs. In our previous post, you started decoding that black box by retracing your steps and identifying patterns. This will help generate three key initial components of the overall framework: your Ideal Customer Profile and alpha versions of your Buyer’s Journey and Go-To-Market Model. We will address the first two and leave the latter for the next post.

I often talk to founders that tell me that they need help implementing a particular business model. When I ask how they got to the model in the first place, the answer I usually get is “I love the Atlassian/Slack/Twilio/etc model”. While you get to decide on a set of customers to focus on, you don’t get to decide on how to market and sell your products. Your customers, to a large extend, already buy a certain way. This is especially true in Enterprise. Forcing your model on them will create friction and result in a suboptimal experience that will soon be exploited by your competition. Your go-to-market model and growth process need to be designed to match the buyer’s journey of your ideal customer.

Ideal Customer Profile (ICP) 1.0

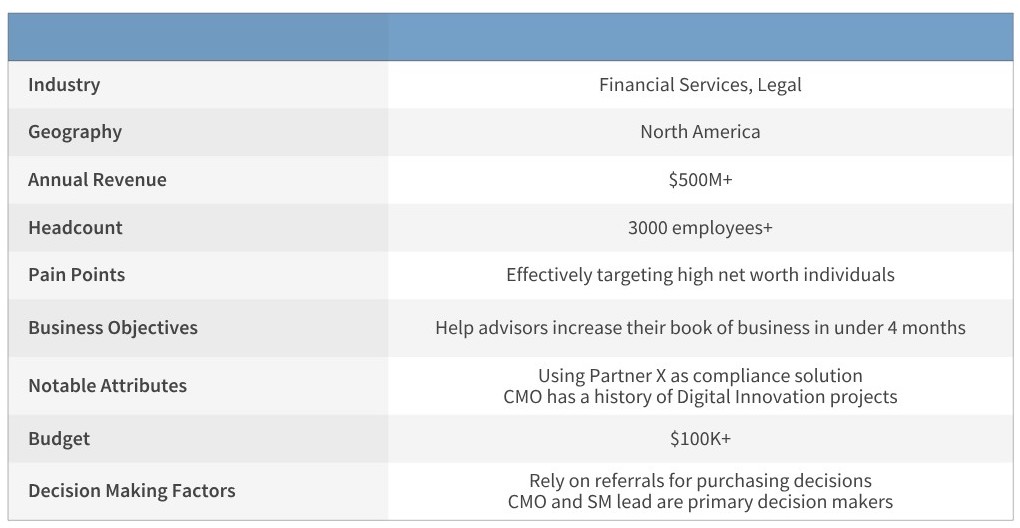

In the previous step you went through the process of conducting interviews with customers, collecting data, looking for common threads among them and validating assumptions. In order to put together version one of your ICP, you need to identify the recurring patterns or characteristics shared by these customers. Over the next 90 to 180 days, this is one of the three frameworks that you will refine on your quest to find reach Go-To-Market fit.

First let’s define an ICP for those of you who aren’t familiar.

An Ideal Customer Profile is a categorical description of the company that’s a perfect fit for your solution.

It informs the types of customers that you should target with your sales and marketing initiatives — not the individual buyer or end user. You are not trying to come up with a buyer persona yet as you objectively don’t know your customer enough at this stage. E.g. Susan from HR, Bob the CMO etc. You will get there over the coming weeks.

The ICP lists out relevant characteristics of the target accounts you identified while picking your best potential target market. Here is an example template that I use:

Take a stab at putting together an ICP for your product and target market. While you are at it, you should put together a list of types of customers to avoid as well. Anything at this stage that will help you stay on mission and nail your go-to-market is useful.

Buyer’s Journey 1.0

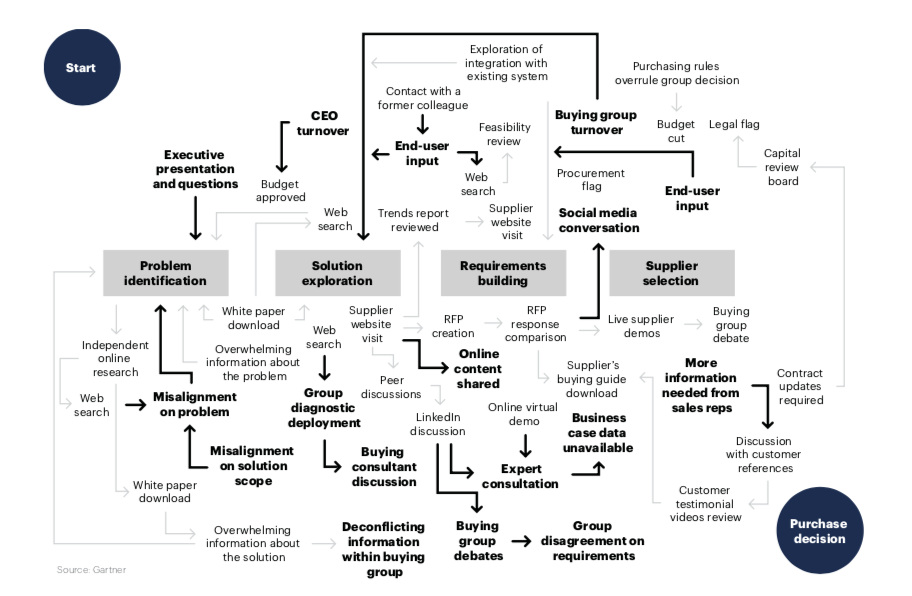

Once you know your customers more intimately and have a full picture of steps taken from awareness to post-purchase you can put together a Customer Journey. At this juncture we will focus on the buying context.

You have probably seen a buying funnel before or a representation of a buying process from awareness to purchase. If you have ever sold or bought anything significant in Enterprise you also know that a typical purchase looks more like this:

When you map this out for your target customers though, patterns will emerge and you can start putting together a general description of the steps typically taken.

The Buyer’s Journey is a simplified representation of the process buyers go through to become aware of, consider and evaluate, and decide to purchase a new product or service.

I emphasize this because far too often, whether we are in Revenue or Product, we build out processes and strategies around the customer journey that are so rigid that no real customers will ever go through them. I have personally been guilty of this more times that I would admit to. Overall though, you should be able to map out and capture the typical steps taken based on the process you went through in the previous post. Here is a template you can use:

The more you break down the steps typically taken by your buyer, the easier it will be to identify what Go-To-Market model makes the most sense. We will address the latter in the next post. Over the next few weeks, as we validate individual portions of the overall model, come back to both the ICP and Buyer’s Journey and keep them up-to-date and complete. This will pay dividends when it comes to collaborating with other parts of the organization, building processes or training new people.

Thank you for reading.